The Psychology of Money: Understanding Our Relationship with Wealth

| September 5, 2024

Money isn’t just for buying things—it’s a big part of how we feel and act. How we deal with money is influenced by our emotions, past experiences, and the society we live in. Here’s a simpler look at how money affects us:

1. How Money Affects Our Emotions

Money can mean safety, power, or even happiness to different people. But how we feel about money can lead to some tricky decisions. For example, fear of losing money might make someone too cautious, missing out on good chances. Conversely, the excitement of making money might push someone to take risky moves that could backfire.

We often worry about not having enough money or compare ourselves to others, which can stress us out. This stress might lead to spending too much to keep up appearances or saving so much that it takes away from enjoying life.

2. How Our Past Shapes Our Money Habits

The way we grew up with money can shape how we handle it as adults. If you grew up in a place where money was tight, you might always worry about losing what you have. On the other hand, if you were raised with plenty of money, you might not appreciate its value and spend it recklessly.

3. Thinking Errors with Money

We all have thinking errors that affect how we manage money:

Anchoring: We fixate on the first price we see, even if it’s not relevant anymore.

Loss Aversion: We fear losing money more than we enjoy making it, making us too cautious.

Overconfidence: We might overestimate our financial knowledge, leading to risky decisions.

Being aware of these errors can help us make better money choices.

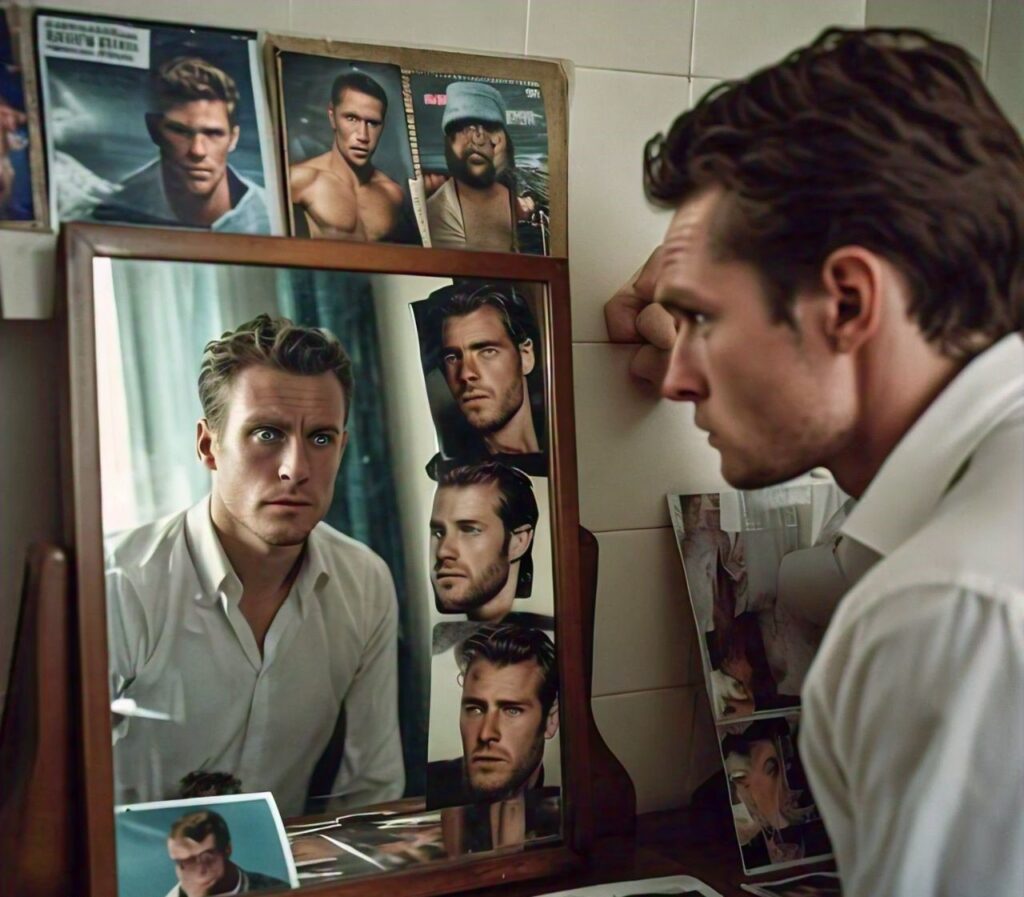

4. Comparing Ourselves to Others

Social media often makes us compare our financial situation to others. This can lead to unhealthy spending to keep up with others. It’s important to focus on your own financial goals and not measure your worth by what others have.

5. Money and Happiness

Money can make life easier, but after meeting basic needs, it doesn’t guarantee more happiness. Chasing after more money can become a never-ending race. True happiness often comes from having a balance—good financial security along with meaningful relationships and personal growth.

Life Lessons from the Psychology of Money

Know Your Emotional Triggers: Be aware of how your feelings about money influence your decisions.

Avoid Comparisons: Focus on your own financial goals instead of comparing yourself to others.

Think Long-Term: Make decisions that benefit your future rather than seeking immediate gratification.

Balance Risk and Caution: Find a middle ground between being overly cautious and taking smart risks.

Money Isn’t Everything: Beyond a certain point, more money doesn’t necessarily mean more happiness. Focus on relationships and personal growth.

Learn from Mistakes: Everyone makes financial errors. Use them as learning opportunities and adjust your habits.

In short, understanding how our emotions and thinking errors affect our money habits can help us make better financial decisions and lead a more balanced life.